At Naker Rating K.K., we provide corporate risk assessment models for both domestic and international companies by combining:

- qualitative insights developed through field experience in corporate credit investigations,

- over 20 years of expertise in international credit reporting, and

- advanced statistical logic made possible by modern AI technologies.

One of the biggest challenges in credit decision-making is articulating the information collected from credit reports or field personnel in a way that feels convincing and understandable.

We deliver the insights needed to interpret corporate information effectively.

Overview of Evaluation Models

Bankruptcy Probability

We offer a streamlined approach to estimating bankruptcy risk using the universal Z-Score model,

with financial figures automatically extracted through OCR technology.

Credit Limit Estimation

The NR Credit Limit model analyzes a company’s financial statements to estimate the maximum advisable amount of accounts receivable exposure.

It provides two types of limits:

- a total credit limit across all transactions, and

- a per-transaction limit.

NRating – Credit Score

NRating is a credit scoring model that incorporates both quantitative and qualitative factors.

In addition to financial indicators, it evaluates elements such as company location and ownership background, highlighting reputation risks that could impact the probability of default.

Recent Blogs

- Gigantic M&A and Credit Management

Toshiba’s Acquisition of Westinghouse (WH) Back when I worked as an investigator at Japan̵

Toshiba’s Acquisition of Westinghouse (WH) Back when I worked as an investigator at Japan̵ - Marelli’s Imminent Bankruptcy and the Implications of a Potential Chapter 11 Filing — Understanding the Role of KKR and Legal Reorganization

Recently, Marelli, a major global auto parts supplier formed through the merger of Japan’s Calsonic

Recently, Marelli, a major global auto parts supplier formed through the merger of Japan’s Calsonic - Challenges in Business Succession: The Case of Akita-ya

Land of Premium Timber My home prefecture, Akita, is renowned nationwide as the birthplace of “Akita

Land of Premium Timber My home prefecture, Akita, is renowned nationwide as the birthplace of “Akita - Sake Industry Reform

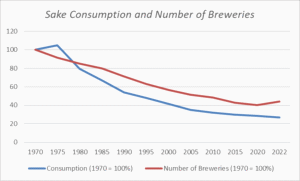

In May 2025, the Japanese government announced a policy to partially lift the ban on issuing new lic

In May 2025, the Japanese government announced a policy to partially lift the ban on issuing new lic - A Failure in Credit Management with Chinese Companies

The Pride of Echizen MerchantsFukui City, Fukui Prefecture. Back when I worked at a UK-based credit

The Pride of Echizen MerchantsFukui City, Fukui Prefecture. Back when I worked at a UK-based credit - Paper Companies – The Strange Mailbox

Beans, Pigeons, and a ShrineKameido, Koto Ward. Walk straight down the shopping street from the stat

Beans, Pigeons, and a ShrineKameido, Koto Ward. Walk straight down the shopping street from the stat - I Believe in This! – The MLM Trap

Wait… What is this place? Sumida Ward, Tokyo.The company had been launched by purchasing a dor

Wait… What is this place? Sumida Ward, Tokyo.The company had been launched by purchasing a dor - Clashing with a Banker—Falsified Financials

A President with a Tohoku Accent Moto-Asakusa, Taito Ward.The first time I met President Tsukita (a

A President with a Tohoku Accent Moto-Asakusa, Taito Ward.The first time I met President Tsukita (a - SME Management Vision: “My ISO”

The Cocky Young Investigator vs. The Stubborn Craftsman Mizumoto, Katsushika-ku. A train ride to Kan

The Cocky Young Investigator vs. The Stubborn Craftsman Mizumoto, Katsushika-ku. A train ride to Kan - Scary People – Facing Ties to Organized Crime

Preliminary Research “Senpai, I got assigned a new investigation on a company run by a guy wit

Preliminary Research “Senpai, I got assigned a new investigation on a company run by a guy wit - The Bankruptcy of a Trusted Company and a Sense of Helplessness

My First Peer CEO Not far from Akihabara, in the Iwamotocho area, was a newly founded company named

My First Peer CEO Not far from Akihabara, in the Iwamotocho area, was a newly founded company named - How to Read U.S. Business Credit Reports – Part 1

The Complaint Magnet I’ve spent over 20 years working in the field of international corporate credit

The Complaint Magnet I’ve spent over 20 years working in the field of international corporate credit