In May 2025, the Japanese government announced a policy to partially lift the ban on issuing new licenses for domestic sake production. (Yomiuri Shimbun, May 27, 2025 Morning Edition)

Until now, new entrants into the domestic sake market were generally not permitted. This policy shift toward deregulation aims to promote regional revitalization and the creation of new value. However, it also carries negative implications such as intensified competition with existing breweries and an increased risk of bankruptcies.

This article delves into the debate over this deregulation from two perspectives: “Tradition vs. Innovation” and “Credit Risk Management.”

1. Tradition or Innovation? — The Value at Stake in New Market Entry

The Case for New Entrants: Diversity and Value Creation

- The participation of young entrepreneurs and businesses from other industries (such as restaurants and tourism) could lead to the emergence of craft sake and SDG-conscious products.

- Leveraging old folk houses and local agricultural resources to develop experiential branding strategies.

- Establishing new sales channels with a view toward inbound tourism and overseas exports.

Pushback from Existing Breweries: Concerns over “Tradition Erosion” and Oversupply

- In a shrinking market, increasing the number of producers could place additional pressure on the operations of existing breweries.

- Brand value and traditional techniques may be compromised by short-term, profit-driven ventures.

- Small, local breweries are at risk of being driven out of business due to limited capital and distribution networks.

2. The Reality Behind the “Sake Boom”: A Contracting Market

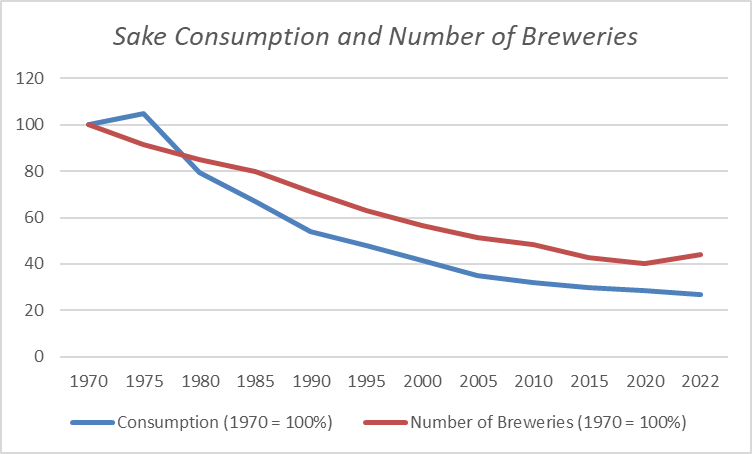

Despite media hype about a “sake boom,” the actual consumption and number of breweries have been consistently declining for the past 50 years.

Chart: Trends in Sake Consumption and Brewery Numbers (1970–2022)

Compiled by Naker Rating from various data sources.

Key Takeaways

- Sake consumption peaked at approximately 1.766 million kiloliters in 1973 but had dropped to just 422,000 kiloliters by 2022—a decrease of more than 75%.

- The number of sake breweries fell from around 4,000 in the 1950s to 1,536 in 2022. Only 1,141 were actually in operation.

- Demand has contracted more rapidly than supply capacity, highlighting a fundamental imbalance.

- While regular sake is struggling, premium varieties like junmai ginjo-shu are reportedly holding steady.

3. From a Credit Risk Management Perspective: Preparing for Structural Failures

Encouraging new entries into a shrinking market raises the possibility of industry-specific bankruptcy patterns.

A Comparable Case: The Cascade of Real Estate Developer Bankruptcies in the 2000s

- During the real estate boom, many small developers entered the market.

- After the Lehman Shock and a slump in sales, these developers went bankrupt.

- The resulting financial shock spread to general contractors, triggering a chain reaction of bankruptcies.

Anticipated Risks in the Sake Industry

- New breweries are likely to rely heavily on loans for equipment and ingredient procurement.

- Failure to adapt to the market could lead to financial difficulties, with some going bankrupt within a few years.

- Financial risk could extend to local logistics providers, bottling companies, and sake rice farmers.

These risks highlight the need for thorough credit assessments and monitoring frameworks for new entrants in the industry.

4. Conclusion: Sustainability Must Be Central to New Licensing Policies

Lifting the ban on new entries in a shrinking market could lead not to revitalization but mutual ruin.

Recommendations for Future Policy Design:

- Grant licenses only to applicants with sustainable business plans, not short-term profit seekers.

- Build regional collaboration models that allow coexistence with existing breweries.

- Establish technical guidance and quality certification systems to maintain standards and brand value.

Should we protect tradition or pursue innovation?

At this crossroads, we must reassess what values are truly worth preserving.